5 Best Free Stock Charts For Technical Trading Analysis

Contents:

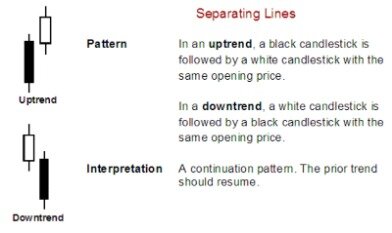

In this article, we will review three types of charts—line charts, bar charts, and candlestick charts. Just like bar charts, candlestick charts have four bits of data per entry – the opening price, closing price, high price and the low price. A similar vertical line called the wick shows the divergence between the high and low price within a given period. A shaded candle represents entries in which the closing price is lower than the opening price while a clear candle shows entries in which the closing price is higher than the opening price. A candlestick chart is easier to analyze compared to the bar chart. It shows the relationship between the highs and the lows very clearly.

10 Best Technical Analysis Software for Trading of 2023 – Money

10 Best Technical Analysis Software for Trading of 2023.

Posted: Tue, 14 Feb 2023 08:00:00 GMT [source]

Oscillators are nothing but the indicators which can be used in a short time span for indicating the same factors and conditions. It is the rate at which the price of the stock changes over a given period. For example, ABC’s price change over ten days – its rate of price changed over these ten days is the momentum of ABC’s shares price.

Types Of Indicators Used In Technical Analysis

When you login first time using a Social Login button, we collect your account public profile information shared by Social Login provider, based on your privacy settings. We also get your email address to automatically create an account for you in our website. Once your account is created, you’ll be logged-in to this account. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future. You can learn more about him on the About Page, or on his personal site RobertFarrington.com. The platform itself is free to use if you open a TD Ameritrade account which has a $0 minimum deposit.

One of the most important components of a chart is the trend line. This is the line which helps in indicating the price trend of the security or overall market for which the analysis is done. If you have heard any technical analyst speak with his or her colleague, then you must have heard this name. It is because Candlestick charts are one of the most used and important charts in this analysis. One can also choose global indices if trading international stocks. They can use the Dow Industrials or the NYSE composite and others.

Prices Move In Trends

For a https://trading-market.org/r who is just beginning his journey can stick to the basic moving averages for tracking the price movement of a share. It becomes easy to understand the price movements as no other factors are influencing the price as per the technical analysis. They think that the demand and supply of the share incorporate all other information of the company and the market.

A guide to price action trading – FOREX.com

A guide to price action trading.

Posted: Mon, 03 Apr 2023 07:00:00 GMT [source]

Individual advance technical analysis analysis to identify the strongest and weakest stocks within select groups. While the example above analyzed the chart for an individual stock, many of these techniques can be applied to charts for sector or broad market indexes as well. Technical analysis cannot predict extreme events, such as a change in management, regulatory changes, and geopolitical events.

Top-Down Approach

As the technical analysts like to believe that prices of shares are only affected by demand and supply, so they chose to ignore any extreme news about some of the stocks as well. You can track the averages daily and it will be easy for you to understand the price movement. You can either use a simple moving average or exponential moving averages, depending on the type of security you are analyzing. In Technical analysis, moving average also plays a great role. It has the most significant when at the uptrend’s top or at the downtrend’s bottom.

- Therefore, the kijun sen price level is often eyed as potentially a good level at which to initiate a buy or sell position following a temporary retracement in price.

- However, it is often seen as being more accurate in the long run.

- There are multiple online tutorials that you can follow along with the self-study curriculum.

- If you listen to the analysts speaking in the interviews or talking about daily price movements of stocks on TV, you must have come across these two terms, haven’t you?

- Many investors leverage both fundamental and technical analysis when making investment decisions since technical analysis helps fill in the gaps of knowledge.

The colour of each candle depends on the applied settings, but most charting packages will use green and red as the default colours. The green candles reflect that price closed higher than where it opened , and every candle that is red means the price closed lower than where it opened . Both technical and fundamental analysis have their advantages and disadvantages. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money. (5.45) It changed a lot already, and will keep on changing from this moment on.

Choose the Right Approach

With affordable, transparent pricing, flexible renewal options and multiple service levels to choose from, it’s easy to find the account that’s just right for you. Plus, our hassle-free account management makes it simple to cancel at any time – no games, no tricks, no runaround. You deserve to stay focused on the charts without worrying about your bill. And most importantly, it is important to have good and complete knowledge about the technical indicators. And the best way to go about doing it is by applying on the markets. If one were to do any form of technical analysis, charting is the most reliable form of tool which is used for performing Technical Analysis.

It is more like the quotation we have been hearing since our childhood “History repeats itself”. For example, the chart in Figure 2 is a daily chart of the S&P 500 that goes back 30 days. The vertical lines of the bars represent the low and high prices at which the S&P 500 traded each day. The small horizontal line on the left side of the vertical bar denotes the price at which the S&P 500 opened each day. The small horizontal line on the right of the vertical bar denotes the price at which the S&P 500 closed for the day.

Thus, a surer sign of trend change is price crossing to significantly below the midline and remaining in the lower band range for several periods. Traders are advised against initiating a trade while the current price level is located within the cloud. When the price is within the cloud, the market is considered to be trendless or ranging.

Skip the hassle of per-contract fees and streamline your trading with Tradier Brokerage and StockChartsACP. Sign up for a free Tradier Brokerage account today to automatically unlock commission-free equities trading via StockChartsACP. And when it comes time to sell, our custom technical alerts will help you time your exits like a pro. Discover the market’s most promising new opportunities with our advanced scanning tools.

When price begins to retrace downward somewhat on the 16th, the MACD shows weaker price action, indicating that the downward movement in price does not have much strength behind it. There is another class of technical indicators, however, whose main purpose is not so much to determine market direction as to determine market strength. Technical traders believe that current or past price action in the market is the most reliable indicator of future price action. TradingView is simple to use but has features for more advanced charting. Lots of people publish charts on TradingView, so there is always some new technical analysis to view. While most of the major finance websites offer free stock charts for investing, these tend to be basic charts that don’t include any technical features.

You can opt for either the basic technical analysis course or the advanced one. You can also pursue one after another for a complete grip on this tool for profitable trading. The most important advantage of using technical analysis is the fact that it is purely based on price – market price. The traders and the analysts only focus on the price of the stock. The vertical line of a candlestick denotes the high and low for the day, similar to the bar chart. The difference between bar and candlestick charts is how candlestick charts display the day’s open and close prices.

We also have in part of technical analysis, overlap studies or trend indicators. It doesn’t matter if you use the Metatrader, or this one; the JForex. (4.27) The japanese approach interpreted these candles here, with most of them being reversal patterns, and doing that the Japanese focused on projecting future prices. The power of the Japanese Candlestick technique was so great, and the westerners were so impressed, that they went on to adopt the candlestick chart.

So, two individual analysts having their own personal biases will end up interpreting the same chart in two different ways. As these shares’ price can be easily manipulated by individual share investors as the number of sellers and buyers are less. For instance, if the previous high was 50 then today it would be 60 and the previous low was 20, today it would be 25. Similarly, the downtrend is characterized by the lower lows and the lower highs. The bricks can be placed within a minute sometimes and it can even take a day or more for the same.

- The volume helps to assess the conviction of buyers and sellers when determining the price of a security.

- It believes that past trading activities and price changes can be a valuable and significant indicator of the securities future price movements as well.

- The former id generally did for day-trading while the latter is for investment in the long-term.

- I simply measure the distance between my entry price and the stop-loss level, and multiply the number by two.

- We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

- The strength or momentum of a trend are indicated by how steep the slopes of the tenkan and kijun lines are, and by how far away from price action, above or below it, that the chinkou span line is.

The Ichimoku Cloud provides traders with a wealth of potential technical indications. The Ichimoku can be applied to any time frame that a trader prefers, from one minute to weekly or monthly charts. Following is a summary of most (I’m sure I’ll leave at least one or two out, there are so many) of the possible trading signals that one can glean from the Ichimoku. The chinkou span line may also serve as an indicator of support/resistance areas. It’s worth noting that the high or low points of the chinkou span frequently match up with Fibonacci retracement levels. Look at the peaks of the chinkou line that occur during the period from August 16 to August 21.

Support and resistance levels in technical analysis are price levels at which the price of a security has historically had difficulty breaking through. These levels can be identified by analyzing price charts and are often used as potential entry or exit points for trades. Technical analysts may also use technical indicators, such as oscillators and momentum indicators, to help interpret price data. Technical analysis charting techniques can be used in conjunction with fundamental analysis, which involves evaluating a security’s intrinsic value based on financial and economic factors. Because the principles of technical analysis are universally applicable, each of these levels of analysis can be performed using the same theoretical background.

The length of the bar indicates the divergence between the high and low price, which increases as the divergence increases. The fundamentals should indicate the characteristics of a market condition reversal that is about to occur. The volume should also be closely checked during the creation of the pattern. Contrary to expectations, double-top designs are the polar opposite of double-bottom ways. A green line indicates the Chikou Span, also known as the trailing span. It is made by changing the current price 26 periods to the left.

Such trading systems rely on clear seasonal patterns, but there are periods when other factors overwhelm the seasonal factors. If you change the time horizon of the holding time of the positions from hours and days to milliseconds, you have high-frequency trading. High-frequency trading is basically exploiting arbitrage opportunities that last just milliseconds. While highly profitable it is also quite capital intensive, as it requires significant investments in IT staff and infrastructure. Competition is so tight that the cost of placing computer equipment in data centers close to the exchange trading infrastructure has skyrocketed.

The thinner parts of the candlestick are commonly referred to as the upper/lower wicks or as shadows. These show us the highest and/or lowest prices during that timeframe, compared to the closing as well as opening price. I like to follow StockTwits Charts, which posts the best charts from the StockTwits network. Now you can see what other traders are looking at and building without having to do any of the work yourself. The use of a simple picture can tell you the story of a complex topic — and that’s especially true when it comes to investing in the stock market. For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure.